I'm saying "corporate" more in the Quaker sense, versus discorporate, or "out of body" which is what some other religions report as closer to their standard m.o.

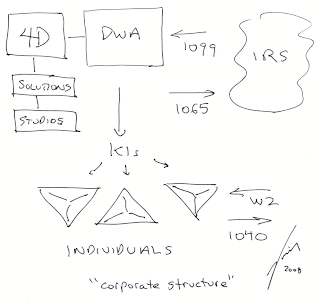

I'm saying "corporate" more in the Quaker sense, versus discorporate, or "out of body" which is what some other religions report as closer to their standard m.o.So like DWA is not a C or S Corporation, nor an LLC or LLP, but an old fashioned partnership of the 1065 variety, formed in the days of Wild West ranches, gold mines, and multiple stake holders. There's a pass-through of gross revenue, minus incurred business expenses, charitable deductions and so on.

Of course in Oregon's ephemeralized Pacific Rim economy (health care, advertising, digital sciences, design and some fab, NGOs, sports shoes and recreation, tourism, casinos), that's more metaphoric, but you'll see how Wall Street uses a lot of the same metaphors (livestock and so on).

The partnership, to the world a hired gun of some kind (Wild West talk again), accrues revenue for its partners, which receive receipts as stakeholders, which show up later in IRS computers, to be reconciled as income on the 1040, the standard way individuals report earnings in this country.

Note that nothing precludes an individual from netting K1 income via multiple partnerships, nor must an individual forswear moonlighting or whatever, i.e. partners need not have bossy relationships, though complementary skills are nice.

In our neck of the woods, medical doctors, other brands of therapist, often gravitate to the partnership model, simply because it's an easy and forgiving template for what are essentially affiliated freelancers or professional practitioners (dentists, lawyers and so on).